Who We Serve

Who We Serve

Helping deliver communities and business partnerships

At C1 Development, we aim to deliver thriving communities through mutually beneficial development partnerships. C1 is a uniquely valuable co-development partner, with access to robust development resources including equity capital through Virtus as well as the highly experienced Virtus team. These resources position us as a reliable full-cycle solution for funding turnkey workforce housing development projects.

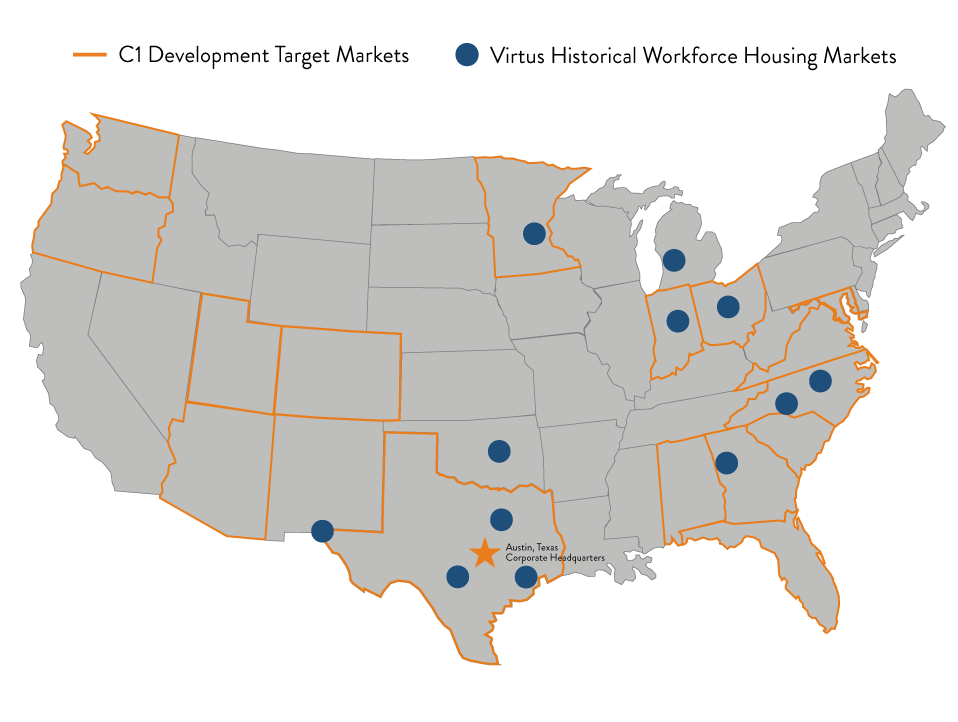

A National Presence

Target Markets

C1’s target markets include both historical Virtus markets and new markets where we anticipate high growth potential through our data-driven approach. In general, our investment markets tend to benefit from strong influences of higher education, healthcare/life sciences, government, and net-migration.

Developing communities to be proud of—today and tomorrow

C1 Development strives to build high-quality multifamily communities that all stakeholders will be proud of for years to come. With each of our development projects, we work closely with cities, municipalities, and other stakeholders to follow a thorough development process from start to finish, ensuring the success and quality of each project.

Trophy Oak

San Antonio, Texas

Trophy Oak

Class-A Workforce Housing

Location: San Antonio, TX

Trophy Oak is a 324-unit Class-A middle-income workforce housing development in Cibolo, a high-growth northeastern suburb of San Antonio, Texas. The property is in a submarket that supports the employment of both military and civilian personnel. With limited local supply and the prohibitive cost of new homes, Trophy Oak helps fill the municipality’s need for affordable, middle-income workforce housing. As a result of a unique Public Facility Corporation (“PFC”) ownership structure established with the municipality, Trophy Oak received a 100% property tax abatement for 75 years. This created significant cost savings, allowing ownership to offer rental rates below those of inferior competitors, boasting strong relative value and a high-quality tenant experience.

The Upton at Longhorn Quarry

San Antonio, Texas

The Upton at Longhorn Quarry

Class-A Workforce Housing

Location: San Antonio, TX

The Upton at Longhorn Quarry (“Longhorn Quarry”) is a 306-unit Class-A workforce housing development located in the northeast quadrant of San Antonio, Texas. Immediately adjacent to Interstate 35 and Wurzbach Parkway, the property benefits from ease of access to the region’s major employment centers. Using a unique Public Facility Corporation (“PFC”) ownership structure with the municipality, Longhorn Quarry received a 100% property tax abatement for 75 years. These cost savings helped deliver a superior Class-A multifamily experience at rates in-line with inferior Class-B properties in the area. This fits squarely within our workforce strategy of providing quality yet affordable housing to blue and grey collar residents.

A Virtus Real Estate Company

Real estate investing for every environment.

Virtus Real Estate Capital is one of the longest-tenured fund managers in the U.S., exclusively focused on cycle-resilient property segments, such as healthcare, education, workforce housing, and storage. Virtus maintains a portfolio that is benefited by having long-term growth drivers, making it more defensive than traditional commercial real estate during periods of economic distress. With Virtus as our parent company, C1 Development and all of our partners have access to Virtus’s expertise and resources.

Firm History

18-year track record of cycle-resilient investing with $1.7 B of equity committed